Toronto is the crane capital of North America — but construction is starting to slow

Despite rising interest rates leading to a decline in new condo sales, Toronto has the highest number of operating tower cranes in North America, a new report by property and consultancy firm Rider Levett Bucknall shows.

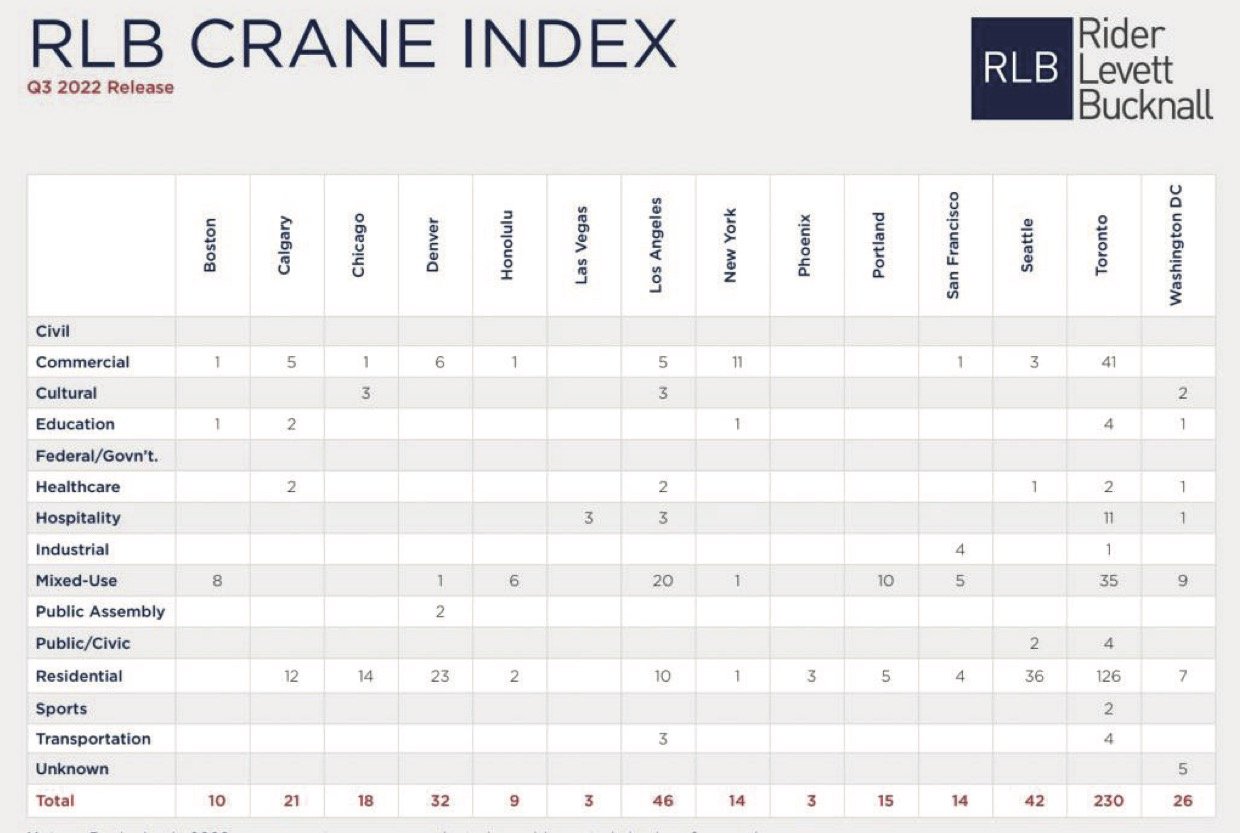

Toronto had 230 active cranes in the sky in the third quarter of 2022. That is five times higher than Los Angeles, which ranked second on the biannual Crane Index of 14 North American cities. The lion’s share of Toronto’s crane count was for residential, at 126 cranes.

Even though there were almost nine per cent fewer cranes than in the first quarter of this year, when there were 252, Toronto has almost as many cranes as the other 13 markets combined, the report said. It attributed the drop to fewer new condo sales and mixed-use projects, along with staffing issues and strikes in Ontario’s construction sector.

Key market indicators are returning to pre-pandemic levels, demonstrating that the industry appears to be recovering from the impacts of COVID-19,” the report notes. However, drivers in the market — including inflation, labor shortage, and supply chain issues — continue to impact construction, whether it be through cost or schedule.

But industry experts aren’t so upbeat about the future of construction in Toronto and the Greater Toronto Area.

Ontario wants to build 1.5 million homes in the next decade. Getting them built will not be easy given the lengthy process of regulations and approval, says David Wilkes, president of Building Industry and Land Development Association (BILD), adding a study by BILD found that it takes on average 32 months from the time the developer submits the application to build until it gets approval. “This is five times longer than the provincial legislation allows,” Wilkes said. He is calling for a ‘fundamental change’ in the way building is regulated and approved.

“We should not be gaining false confidence for the number of cranes that are currently in the sky,” he said. Without changes, “We are going to really be in the middle of the storm in three, four or five years out, where we don’t see the cranes dotting our skyline.”

Inspite projected improvements, the report warns that Ontario has “a very narrow window of opportunity” to complete critical infrastructure projects. This is due to several factors, including a long backlog on Ontario One Call, which requires builders and developers to call before they start digging, union strikes, inflation, and the shortage of skilled workers.

Natasha Carew, a litigation partner at multinational law firm Gowling WLG in Toronto, added that disputes in the construction industry “appear to be on the rise,” particularly in the public, private, and partnership projects.

Our anticipation is that disputes will continue to escalate over the next few years,” affecting the construction sector. Carew said that a novel factor affecting the disputes is the war in Ukraine. “We are starting to see claims being contemplated or prepared related to material shortages and price increases,” she said.

In Calgary, the only other Canadian city in the index, there were 21 tower cranes, 12 of them for residential projects.