Developers are hitting the brakes. Pandemic buyers are panicked as appraisals come up short. Is this the end of Toronto’s condo mania?

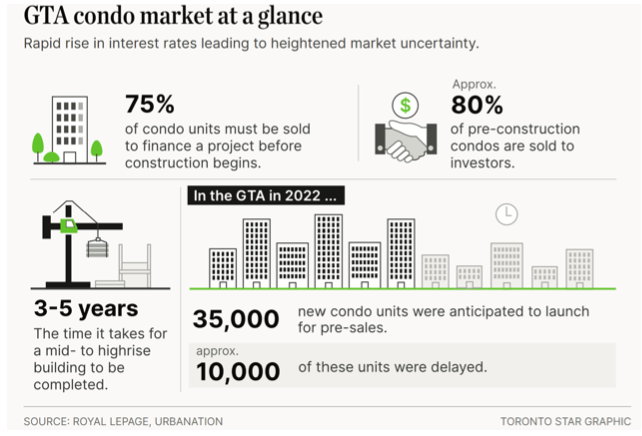

A pre-construction condo in the GTA was a safe way to invest and gain equity. Indeed, for a decade this seemed like a solid bet. Investors poured money into condos, which sprouted like weeds and dramatically transformed the Toronto skyline. Around 80 per cent of pre-construction condos are sold to investors.

But since the March 2022 price peak for condos, prices have dropped in both the 905 region and Toronto by an average of $91,000.

As the possession dates for these new condo owners nears, the bank appraisal, which is done to ensure the current market value of a property is in line with the size of the mortgage loan, many condos are falling short of the appraisal value. Some as much as $200,000, less than what they paid for it two years ago. What’s more, the variable mortgage rate advertised when they signed the purchase agreement in 2020 was around 1.5 per cent. Now, it’s closer to six per cent.

Instead of being able to borrow all the money they need from the bank to pay the developer for the unit, they now have come up with the cash to make up the difference. Some buyers are wondering how they are supposed to close the transaction. Appraisals are coming in so low; people don’t have the extra $100,000 to $200,000 to close.

If presale condo buyers want to get out of their purchase agreement — either from low appraisals or unmanageable mortgage rates — at best they lose the deposit (typically 10 to 15 per cent of the unit cost) and walk away from the agreement. But the developer can sue for significant damages, which can force buyers to declare bankruptcy.

Rising rates and inflation are also hitting developers, as the cost of building goes up. It’s all starting to impact condo projects as investors back out of deals and some developers decide to wait on the sidelines for the market to settle. For the first time, it’s beginning to look like there are cracks — large ones at that — forming in Toronto’s once-booming condo market.

GTA pre-construction condo sales in the third quarter of 2022 declined by 79 per cent from a year ago. Outside of the initial months of the pandemic in the second quarter of 2020, this was the lowest quarter for GTA new condo sales since the 2009 financial crisis, according to a report from Urbanation, a development-tracking market research firm. The long-term impacts could be significant, real estate experts say, as new development slows, further straining the city’s housing supply shortage. As a result, prices will be pushed higher as demand continues to outstrip supply in the coming years.

At the beginning of 2022, around 35,000 new condo units were anticipated to launch in the GTA. Of those, 10,000 units have been delayed. Some projects will no longer be possible to build after not meeting their sales targets to qualify for construction financing. “In the GTA, the primary form of new housing is condominiums and primary purchasers are investors,” said Shaun Hildebrand, president of Urbanation. “When investors become uninterested it directly interferes with the supply pipeline. It’s a problem.”

For a new condo building to be built, 75 to 80 per cent of the units must be sold beforehand to finance the project. On average, it takes three to five years for a mid- to high-density building to be built from start to finish. That means developers rely on the sale of the units to see the construction of the building to the finish line.

There are also troubling headwinds from the rise in assignment sales — a legal transaction in which the original pre-construction condo buyer transfers the rights and obligations of the purchase agreement to another buyer.

In Ontario the number of assignment listings grew 73 per cent between March and April 2022 following the first Bank of Canada interest rate increase. From July to September, assignment listings rose by 129 per cent, according to data from BrokerPocket, a real estate agent-only platform for off-market listings. Typically, in a 300-unit building, there would be approx. 30 assignment listings. Now, its it’s closer to 60 listings.

The slowdown in new condominiums sales and presale launches is not expected to negatively impact construction activity until the second half of 2023, as developers remain active starting work on the large number of units sold in previous quarters, the Urbanation report found.