Toronto listings are starting to see multiple offers starting up again. What has happened in the last week that has caused this frenzy?…

Read moreMARKET INSIGHT FOR THE WEEK ENDING FEBRUARY 2nd, 2024

MARKET INSIGHT FOR THE WEEK ENDING JANUARY 26th, 2024

Foreign buyers who want to purchase a home in Toronto could soon face an even steeper price tag if city council approves a new municipal tax that aims to curb real estate speculation…

Read moreMARKET INSIGHT FOR THE WEEK ENDING JANUARY 19TH, 2024

Have you done your declaration for your home occupancy status for 2023? …

Read moreMARKET INSIGHT FOR THE WEEK ENDING JANUARY 12TH 2024

This week City Council in their 2024 budget meeting proposed a Toronto property-tax rate jump to 10.5%, the largest single-year increase since amalgamation in 1998. If the city doesn't receive $250 million in funding from the federal government an additional 6% increase could be added, resulting in a total tax hike of 16.5%…..

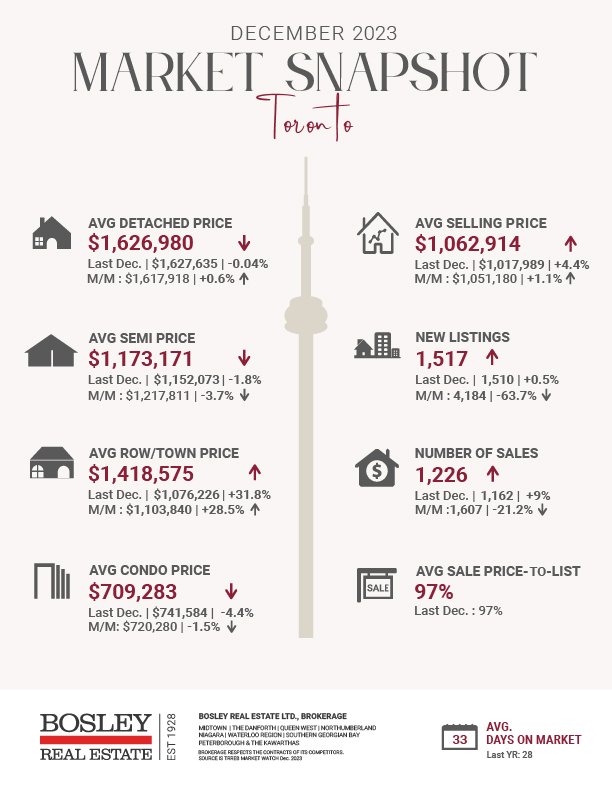

Read moreMARKET UPDATE FOR DECEMBER 2023

MARKET INSIGHT FOR THE WEEK ENDING DECEMBER 15TH, 2023

Why Toronto is seeing more ‘vendor take-back’ mortgages as pre-construction appraisals fall short.

Buyers who have purchased a pre-construction freehold property and have received an appraisal that's fallen considerably short of their original purchase price, are sometimes offered a vendor take-back mortgage, which can act as a lifeline, lawyer says.

Vendor take-back mortgages (VTB) offer an alluring option for buyers who have bought a pre-construction home but have seen their appraisals fall short by hundreds of thousands of dollars, as Toronto tries to find its footing in a high-interest rate environment.

Buyers who have received an appraisal that’s considerably short of their original purchase price are sometimes offered the mortgages as a lifeline, said Mark Morris, a lawyer at real estate law firm Legalclosing.ca. <https://www.Legalclosing.ca>

A vendor take-back mortgage is when the seller of the home lends money to the buyer — essentially acting as a bank by allowing the homebuyer to borrow money in order to purchase the seller’s home. The loan is typically offered for one or two years and can cover part or all of the purchase, Morris explained.

“We’re seeing this more and more,” he said, adding it’s specifically with smaller developers and builders, who are seeing more buyers walk away from their purchases — especially as a growing number of homebuyers are leaving behind sizable deposits, some worth as much as $320,000. The top developers aren’t offering take-back mortgages because their pre-construction condos and freeholds aren’t being hit by the same appraisal shortfalls compared to smaller developers who built on less profitable land and are over-leveraged.

“It’s happening with smaller building companies making single-family homes because they took big leaps in regions that don’t have great land valuations,” he added.

Builders who feel they won’t be able to find another buyer and need to continue to finance the project, will sometimes offer a vendor take-back mortgage to the buyer. In some cases, it might make more sense for the buyer to try and sell the property and in others, the take-back mortgage can provide the necessary financing to close the purchase.

Some builders are realizing they have a growing number of pre-construction buyers who won’t be able to close and new buyers won’t scoop up those properties.

Some vendor take-back mortgages are also being offered in the residential resale market, where the deals offer one more way to close the deal. However, several mortgage brokers in Toronto told the Star they haven’t seen any increase in this product in their respective practices.

If the buyer fails to make the payments to the seller, they would need to enter legal proceedings — just as a bank would if the buyer defaulted on the mortgage.

It’s unlikely first-time home buyers would have a vendor take-back mortgage as they would need a standard mortgage from a bank, which would likely prohibit secondary financing on the property. The seller can also only offer the take-back mortgage if they have enough equity in the property to act as collateral in case the buyer is unable to pay back the mortgage loan.

MARKET UPDATE FOR NOVEMBER 2023

MARKET INSIGHT FOR THE WEEK ENDING December 1st, 2023

The Bank of Canada is widely expected to hold its benchmark interest rate when it meets next week, but a lot has changed since October.

Why the Bank of Canada could cut interest rates much more than markets expect.

Cooling inflation, here and south of the border, and a weakening economy have turned markets’ attention from rate hikes to rate cuts.

Investors are now fully pricing in a 25-basis points rate cut by April, a 75 per cent chance by March, and even a 20 per cent chance by next week. ….

Read moreMARKET INSIGHT FOR THE WEEK ENDING November 24th , 2023

n Canada's housing market, it matters who your parents are. Children of homeowners twice as likely to own a home, finds Statistics Canada study.

Getting on the property ladder is so tough these days more young Canadians despair of ever getting to the first rung.

Prices have cooled since the pandemic housing boom, but higher mortgage rates are a new hurdle for would-be buyers.

A new study by Statistics Canada has found that some Canadians have an advantage for getting on that ladder over others — their parents.

The study, according to the agency, provides the first detailed analysis of the relationship between parents who own property and the likelihood of their children owning a home, using tax data and data from the Canadian Housing Statistics Program.

Statistics Canada’s novel database combines records from 3.4 million parents and 2.6 million of their kids born in the 1990s. The report is the first in a series investigating inter-generational housing outcomes in Canada.

It found that adult children born in the 1990s whose parents were homeowners were twice as likely to own a home than those whose parents were not homeowners.

Children of homeowners had a homeownership rate of 17.4 per cent, compared with a homeownership rate of 8.1 per cent for the children of parents who did not own a home.

The homeownership rate of children whose parents owned more than one property was even higher at 23.8 per cent, nearly triple the rate of the children of non-homeowners.

The study also found “significant differences” between the average income of the adult children who owned a home and those who did not. The average income of non-owners was $36,000, while homeowners had an average income of $65,000.

The average income of adult children with parents who owned multiple properties was about $6,000 higher than those of non-homeowners.

Where you live also makes a difference. Canadians born in the 1990s had the highest rates of homeownership in New Brunswick at 20.5 per cent and the lowest in British Columbia at 14.1 per cent, reflecting that region’s high property price.

The gain from parental property ownership to the homeownership rate was also highest in Ontario and British Columbia.

“This may signal that in housing markets with higher property values, where higher incomes are necessary for ownership, parents’ property ownership or wealth plays a larger role in their adult children’s homeownership outcomes,” said the study.

Growing unaffordability of housing in Canada has increased younger generations’ reliance on the so-called bank of mom and dad.

Statistics Canada cites a CIBC study that showed between 2015 and 2021, the share of first-time buyers who received a financial gift from family rose from 20 per cent to 28 per cent, and the average amount of the gift rose from $50,000 to $80,000.