BLOG

FEATURED POSTS

Let’s agree to call the next few weeks the ‘calm before the storm’. Every year, in the days leading up to the Christmas holidays, the Toronto real estate market takes a little breather. After the biggest year on record in terms of transaction numbers and price appreciation, we feel some rest and relaxation is well earned. Judging by the activity around our offices we know that 2016 will be another strong year. We hope you have enjoyed our weekly market updates and look forward to reporting on Toronto’s downtown core in the new year.

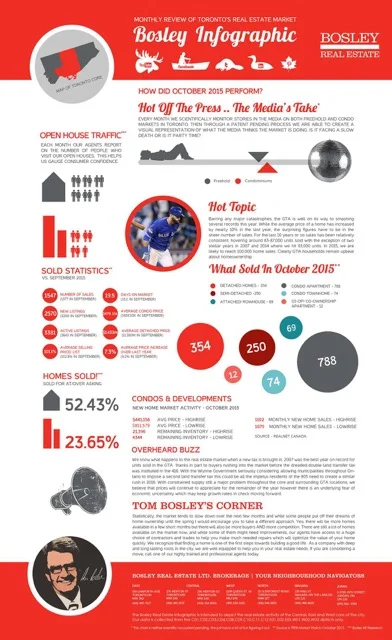

Curious to know how many homes were sold last month? How many condos? How much traffic the Bosley team got from open houses? All this and more in this month’s real estate review.

Last week we reported that the Spring real estate market is in full swing in Toronto now that the warmer weather has arrived. At our offices we’ve put away the salt bags, rolled up the winter mats and cleaned the windows. While Buyers heard us loud and clear, Sellers apparently didn’t get the memo as both the number of freehold and condo listings backed off last week. For now we are going to blame it on last week’s tequila hangover and Cinco de Mayo.

Freehold home listings retreated by a staggering 24% last week. This was one of the largest week-over-week decreases in a number of months with the biggest decrease in new listings happening in the central core’s $1.5m to $3m price range.....

2014 will go down in Toronto’s history as the year of extreme cold and a piping hot real estate market. While we are hesitant to say that the bitter deep freeze is over just yet, the real estate market shows no signs of cooling. This week we witnessed another strong week of multiple offers and frustrated buyers. With daylight savings just a few sleeps away, we are looking forward to warmer weather, drier sidewalks and hopefully more listings.....

ABOUT THIS BLOG

placeholder text

OLDER POSTS

Ontario home sales are projected to rise by nearly 10% in 2025, driven by pent-up demand from buyers awaiting further interest rate cuts. This could lead to significant momentum starting in the spring or summer of next year.

The Canadian Real Estate Association (CREA) forecasts a more stable real estate market in 2025 following…

A surge in demand for homes is anticipated as many potential buyers wait for mortgage rates to drop further, according to a recent TD Economics report.

The forecast suggests that despite some reductions in mortgage rates recently, a significant number of buyers remain on the sidelines, hoping for deeper cuts from the Bank of Canada, which would lead to even lower mortgage costs.

The Buyers Are Back: Toronto Home Sales Jump In September

A true market rebound is likely still a ways off, but signs of life were detected in the GTA housing market this September, according to the Toronto Regional Real Estate Board’s (TRREB’s) latest Market Watch report.

Mortgage stress test requirement has been lifted for renewing borrowers who change lenders.

Canada’s banking regulator will no longer require banks to apply the mortgage stress test to borrowers looking to switch lenders. The Office of the Superintendent of Financial Institutions (OSFI) has confirmed that it plans to inform lenders of its decision to remove the expectation of applying the stress test to mortgage holders seeking to renew with a different lender.

As you may have already heard through the media, the Government just announced a major change in mortgage rules, which is great news for homebuyers. What is the Government changing?

Toronto area new home sales continue to drop and hit an all-time low in July.

Sales of newly built homes continue to decline, with July hitting an unprecedented low for the month. The number of new project releases has been minimal, and months of inventory continue to rise.

Mortgage stress test requirement has been lifted for renewing borrowers who change lenders.

Canada’s banking regulator will no longer require banks to apply the mortgage stress test to borrowers looking to switch lenders. The Office of the Superintendent of Financial Institutions (OSFI) has confirmed that it plans to inform lenders of its decision to remove the expectation of applying the stress test to mortgage holders seeking to renew with a different lender.